Questions? Call now: 307-429-2947

The $0 Down Lie That Destroys New Investors

Published on: 05/08/2025

Chasing $0-down deals with no savings or plan? Learn the real steps to start investing smart and avoid costly beginner mistakes.

Creative FinanceBest Practices

How to get a subto deal under contract

Published on: 05/08/2025

Learn how to get your first subto deal under contract (or how to get better at getting solid deals).

ContractsCreative Finance

Understanding Wraparound Mortgages in Real Estate

Published on: 04/08/2025

Learn how wraparound contracts work, their benefits and risks like due-on-sale clauses, and how CreativeTC helps structure creative financing deals.

Creative FinanceWraps

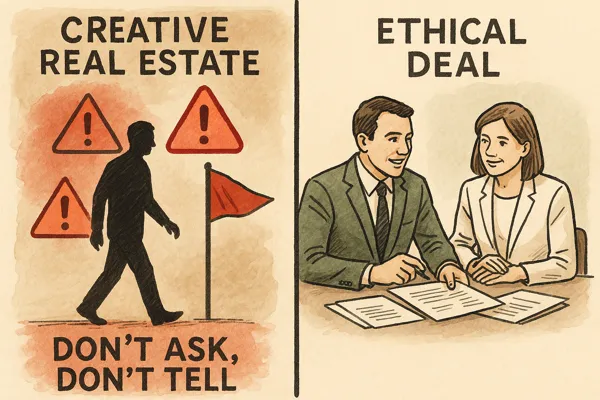

“Don’t Ask, Don’t Tell” Doesn't Work in Creative Finance

Published on: 23/05/2025

Think “don’t ask, don’t tell” is going to allow you to plead ignorance? NOPE! Avoid legal risk with ethical, transparent deal structure & communications.

Creative Finance

© 2025 Creative TC LLC - All Rights Reserved.

All content on this site is protected by copyright and is not authorized for use by others.